SK Square = Discount Squared

Compounding discounts on the memory supercycle

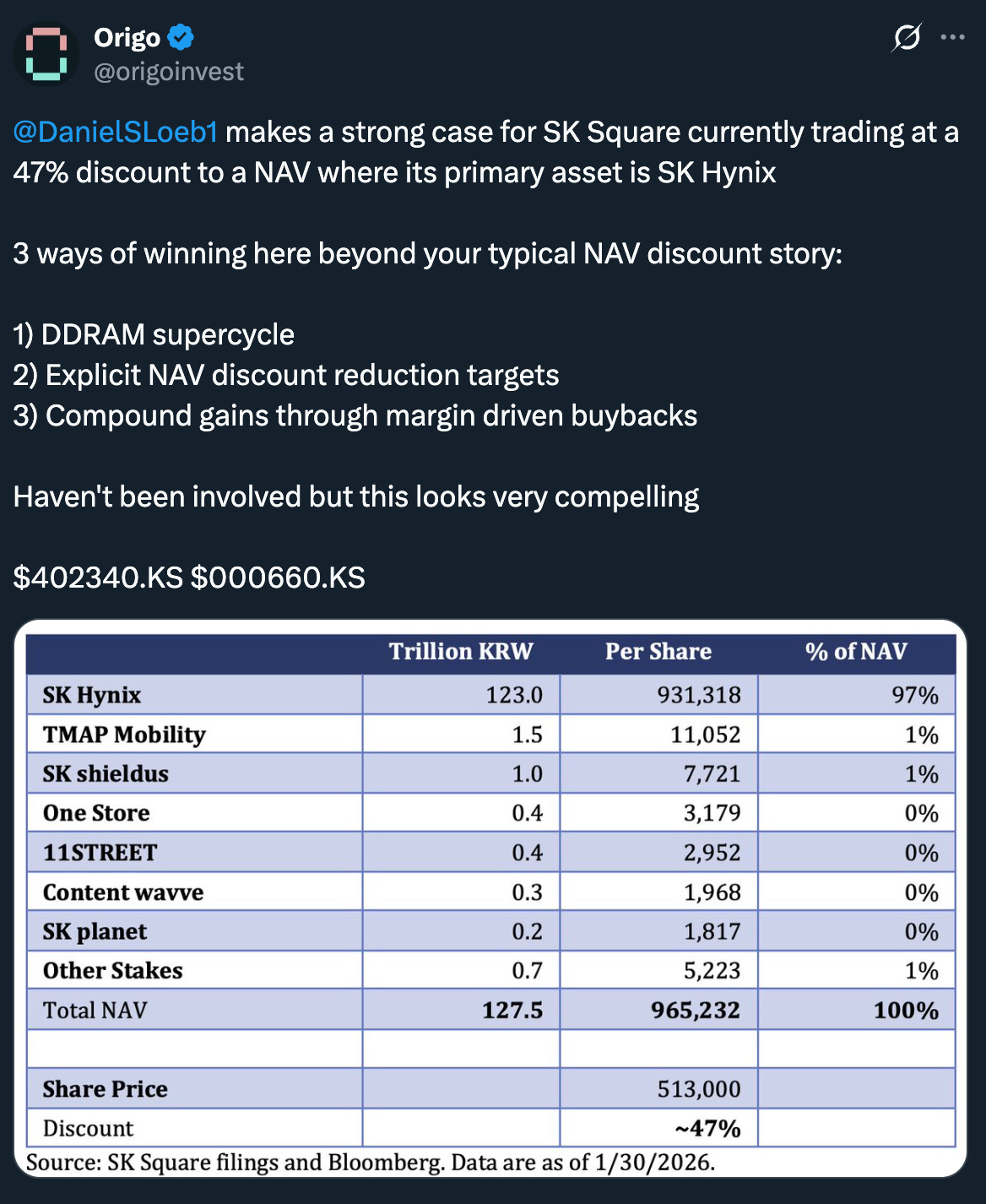

I came across SK Square reading Dan Loeb’s Q4 investor letter over the weekend. The thesis was compelling and straightforward enough to be distilled down to less than 20 words:

Investor letters can be a great source of investment ideas but you always have to do your own work (no matter the investment hero).

Let’s breakdown the thesis before running some numbers on potential outcomes.

Layers of discount

As I alluded to in my X post I am usually wary of one dimensional NAV discount stories. There are countless listed HoldCos, REITS, closed-end funds and more that languish in sideways price action with no real catalyst or momentum.

What made SK Square immediately interesting to me is that there are 3 embedded layers of discount here and each one has a plausible potential to re-rate:

SK Hynix: memory cycle re-rate

SK Hynix: Korea discount

SK Square: HoldCo (+ Korea) discount

Memory cycle re-rate

SK Hynix is one of three key players in DRAM memory alongside Samsung and Micron in what has historically been a very cyclical and commoditised industry characterised by brutal price swings.

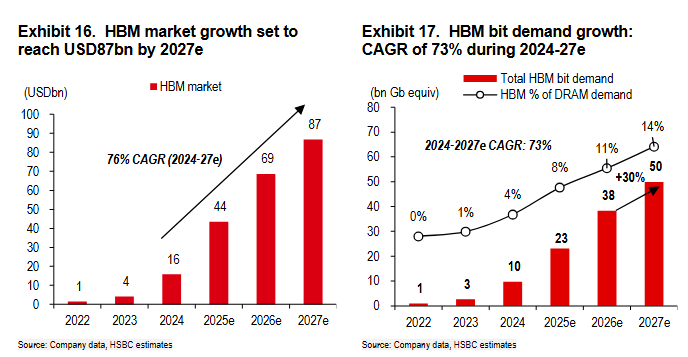

The supply shortage and strategic nature of memory chips in AI inference and compute has been well documented by now and is at the heart of what many argue to be a structural shift away from past cycles.

SK Hynix in particular is the leader in high bandwidth memory (HBM) with a >50% market share. Most notably, HBM is driving a disproportionate amount of AI compute demand growth and is characterised by added complexity compared to traditional DDRx DRAM, resulting in significant pricing premium (in the range of 3-5x).

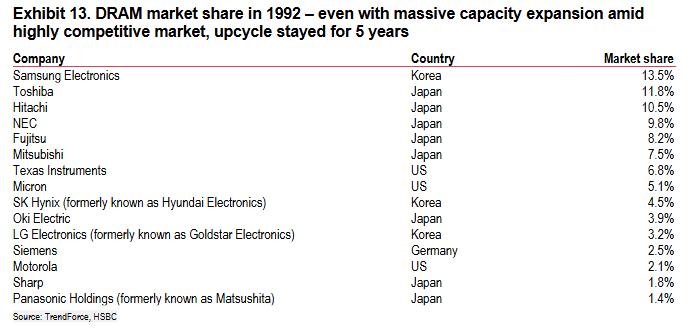

Whilst we can debate the stickiness and differentiation of the HBM market within the new paradigm of AI compute, an interesting side note is that the memory boom of the early 90s (which was characterised by significantly more intense competition) resulted in at least 5 years of upcycle.

The Korea discount

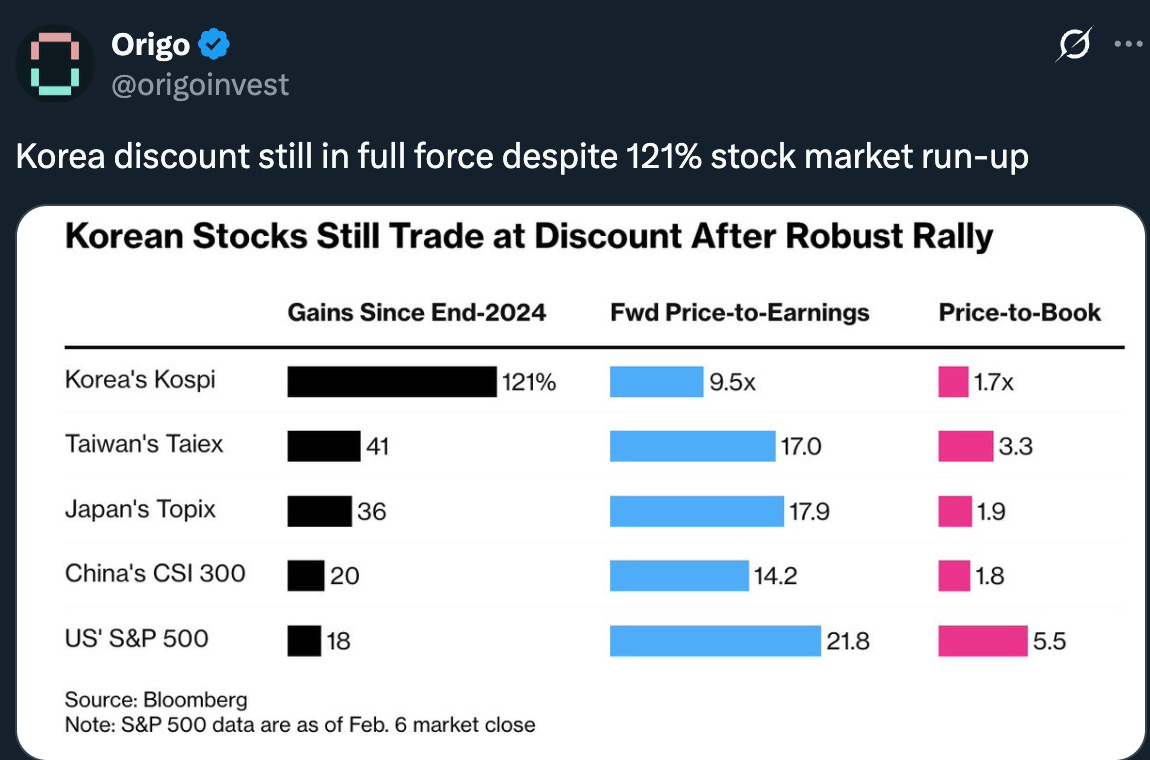

The South Korean stock market has perennially traded at a discount to global peers for reasons as diverse as Chaebol market structure, corporate governance concerns, capital allocation efficiency and market access. Similar to what we have been seeing in Japan in recent years, there has been a strong desire from the government to shed legacy concerns and appeal to both domestic and foreign investors. In 2024 South Korea introduced the Corporate Value-Up Program with a view to incentive corporate transparency and shareholder alignment on core KPIs. While the jury is still out on the full effectiveness of these measures, South Korea has been one of the top-performing stock markets since the end of 2024. Even with this rally however the discount still persists.

SK Hynix is no exception to the rule. Despite its technological leadership in HBM which should arguably place it at an advantage versus peers, SK Hynix currently trades at only 6.1x 2026E consensus earnings compared to a forward P/E closer to 12x for Micron.

Independent of whether the South Korean market continues on its upward trajectory, SK Hynix is considering issuing an ADR which could also be a significant catalyst in helping close the valuation gap.

HoldCo discount

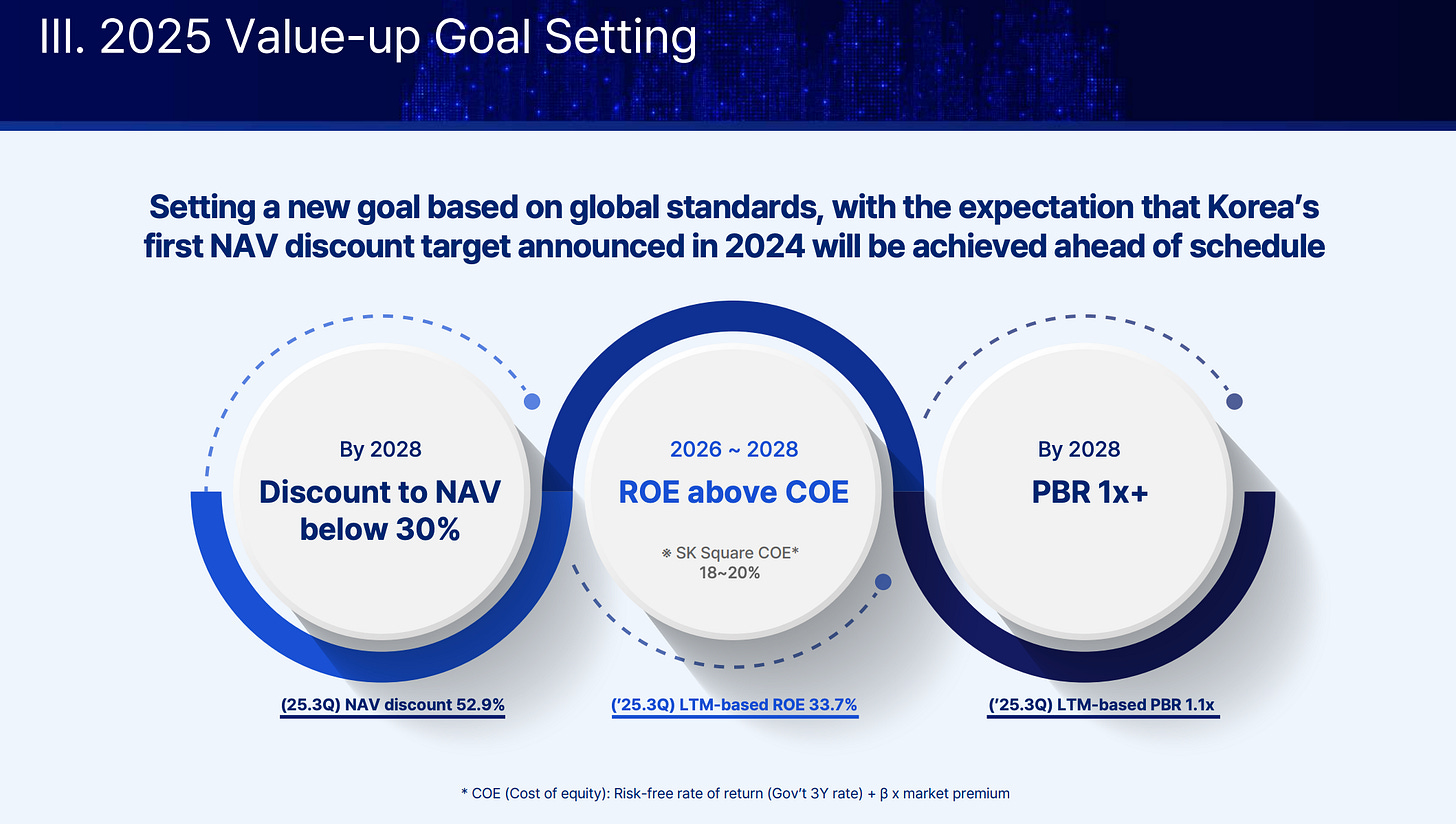

In late 2024 Sk Square released its 2025 Value-Up plan in which it identifies the reduction of the HoldCo NAV discount as the single most important KPI.

In addition to specifying a medium-term target of 30%, management have made share buybacks an important component of their overall strategy. Considering SK Hynix constitutes >96% of SK Square’s NAV and is the second largest and most liquid component of the KOSPI, it stands to reason that SK Square’s discount should be at the lower-end of peers (note: we think ~30% is reasonable as it also implicitly allows for CGT and other leakage).

One suggestion Third Point puts forward as a strategy to take advantage of the HoldCo discount in the short-term is to raise capital collateralised by SK Hynix to repurchase shares in SK Squared. Doing so at these levels would be very attractive and by compounding the discount at both levels this could also be its own catalyst towards driving the medium term NAV discount lower.

Putting it all together

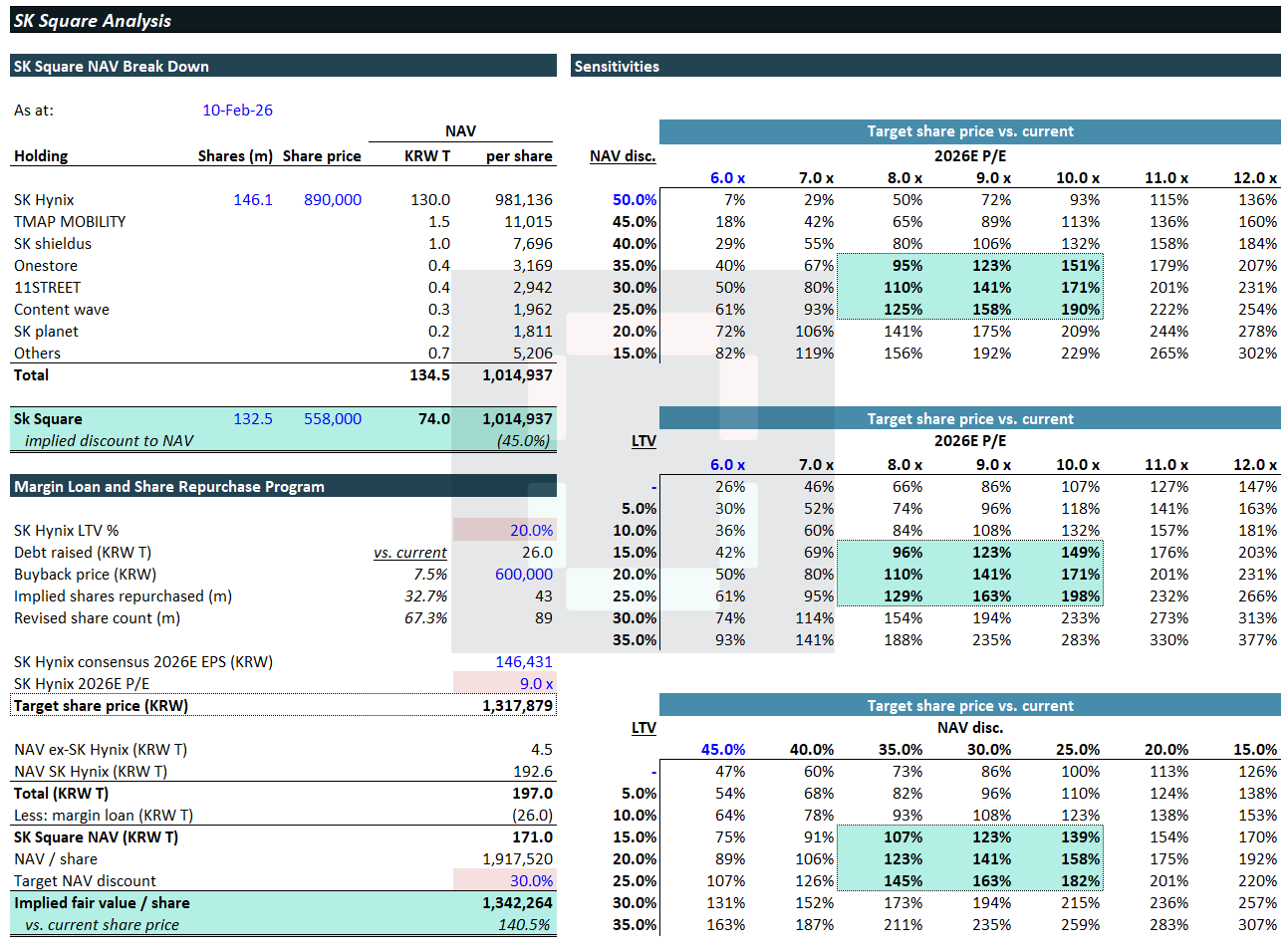

I have re-created the SK Square NAV analysis updated as at 10-Feb-26. Note that outside of SK Hynix, the remaining holdings are predominantly private investments which are marked at historical deal values. We assume these are static and given these represent less than 4% of NAV have minimal impact on the analysis.

In our “base case” we are assuming a SK Hynix margin loan at 20% LTV resulting in KRW 26T which SK Square utilises to repurchase its shares at a level ~7.5% north of current prices. This would equate to a 32.7% reduction in shares outstanding. We then take the 2026E Bloomberg consensus earnings and apply a 9.0x multiple which is the mid-point between SK Hynix and Micron today. If the Company can hit its 30% NAV discount target, this would result in a price per share of KRW 1,342,264 which would represent a 141% uplift.

I do not think these assumptions are particularly heroic and could in fact surprise to the upside if SK Hynix continues to beat expectations.

We love situations like this where we are buying value but there is a real opportunity for momentum and positive reflexivity.

We are making the underlying excel available to paid subscribers, please feel free to download and play around with your own assumptions on this one.