Private Credit & BDC Debacle: Facts vs. Fiction

+ are $OWL and $OBDC oversold?

Decided to share some weekend thoughts on this given there has been a fait bit of hyperbole on the topic over the past couple of weeks.

Also because indiscriminate selling typically generates opportunities for anyone willing to do the work and look past the headlines.

I’ve been critical of many aspects of the private credit bubble as GPs battle for AUM growth amid a “race to the bottom” in terms of underwriting standards.

The objective of this post is to briefly separate fact from fiction before taking a closer look at whether the current debacle is a source of opportunity.

For background I have >12 years experience at various Megafund GPs and am well-versed in the credit space. I regularly speak with major GPs and LPs.

Fact or Fiction: Private Credit is a larger share of the economy and underwriting standards have been deteriorating

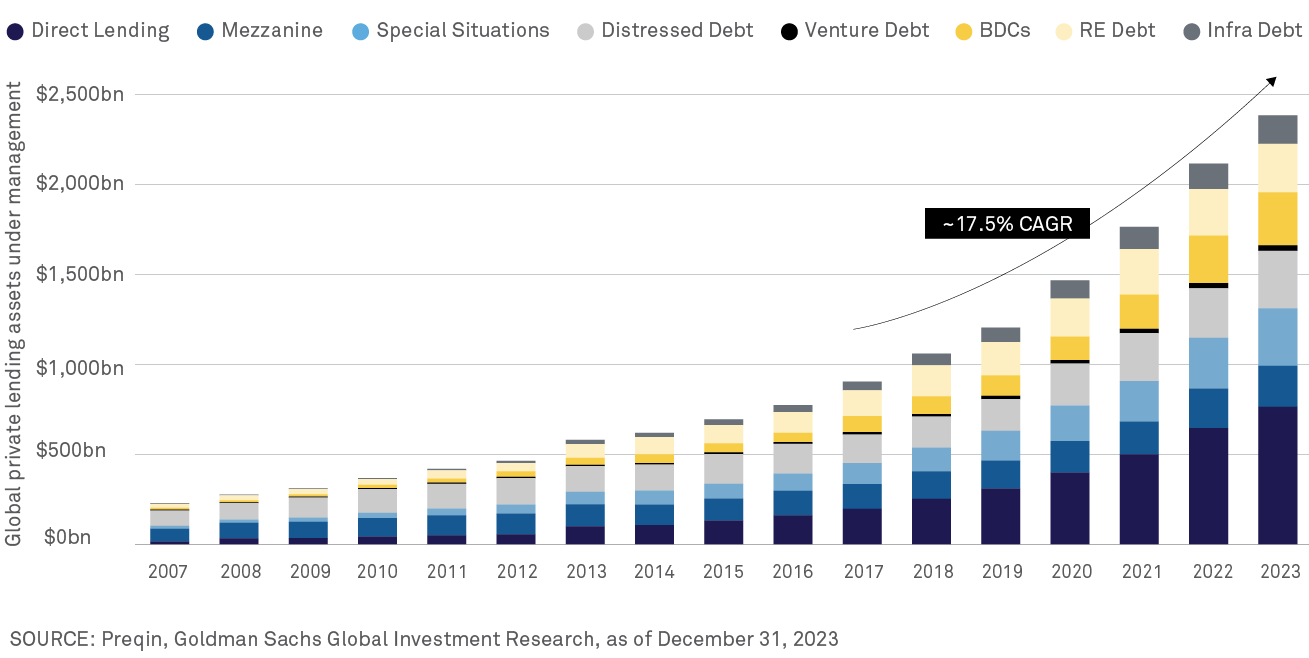

Yes this is absolutely true. Bank regulation has allowed an entire non-bank lending ecosystem to develop and fill the vacuum. The AUM of Credit related strategies has effectively 10x’d since the GFC:

Private Credit truly accelerated when we went into a rate-hiking cycle. Equities and related strategies were getting hammered post Covid bubble. Meanwhile, there were opportunities to lend on a senior secured basis at SOFR + 700-900 implying all-in rates at >12% in cash flowing businesses. This type of product is incredibly attractive to large institutional LPs that need to deploy at scale and are downside protection oriented.

GPs were scrambling for exposure, those that were behind such as Caryle were offering zero incentive fees to LPs.

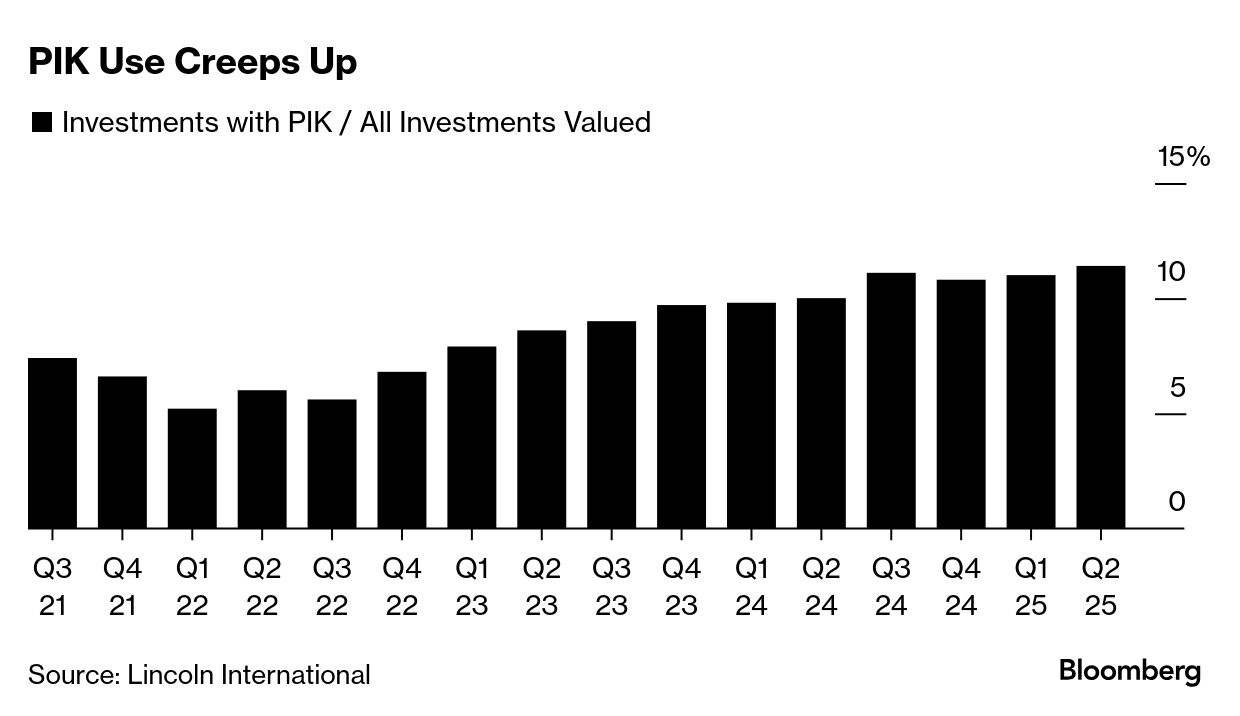

A ton of capital went into the space that subsequently needed to be deployed. Meanwhile competition from banks and recovering capital markets shifted the supply demand balance. Past 24-36 months we have seen a significant amount of spread compression, weaker documentation (cov-lite loans) and an increase in the use of PIK interest (non-cash, back-ended interest).

Fact or Fiction: Private Credit is a systemic risk

The media and X are always quick to jump to extremes though when the reality is much more nuanced.

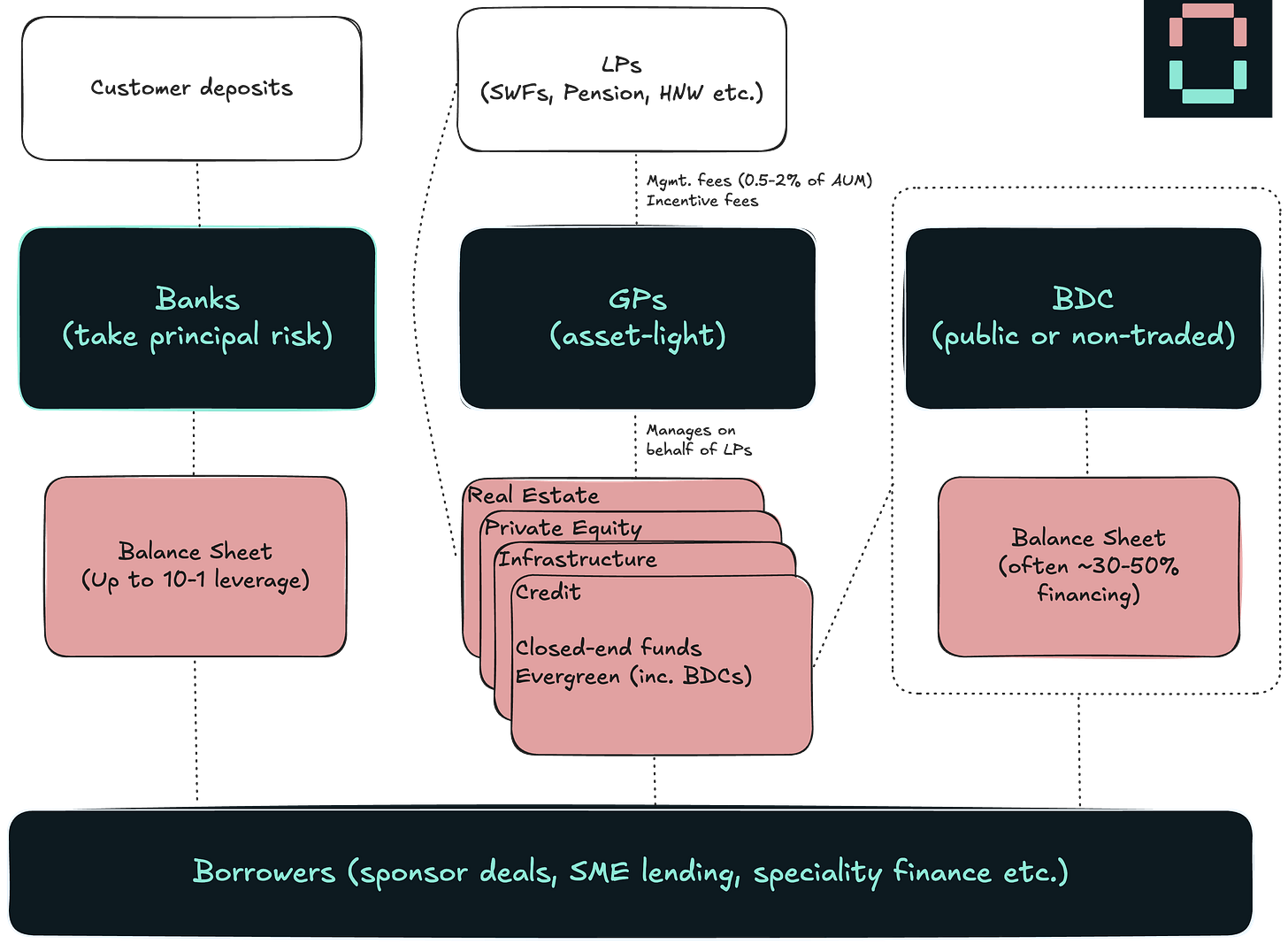

To answer this question, lets remind ourselves of the fundamental difference between GPs, BDCs and Banks and where the end-risk lies:

Banks: make money by earning an excess spread on its customer deposits.

Banks operate on a fractional reserve model and are often leveraged up to 10-1. Any default in its loan book directly affects its P&L. Customer deposits are FDIC insured but only up to a certain amount. Post GFC regulatory capital requirements are much more restrictive. Banks need to carefully manage duration given the short-term nature of deposits.

Alternative Investment GPs: asset-light fee based model, manage capital on behalf of third-party clients

Large GPs will be diversified across several verticals (Private Equity, Real Estate, Credit, Infrastructure, Secondaries etc.). Other than a small GP commitment, they do not put their balance sheet at risk.

Instead they raise capital, predominantly from institutional LPs ranging from SWFs to Pension Funds to Family Offices. Unlike with bank customer deposits, these LPs are specifically seeking investment returns in a given strategy.

In Private Credit the GP will earn a fee stream on the fund split between management (~1-1.5% of AUM) and incentive (8-10% subject to outperforming a hurdle of ~6% over the fund-life). This model is effectively borrowed from classic Private Equity fund structures, except with lower fees.

In particular the incentive fee is much less meaningful given a fund’s target MOIC will typically be closer to 1.3x than 2.0x and as a result Private Credit has predominantly been an AUM game.

Most funds are “closed-end”. This means that there are no redemption mechanics and LPs only get their capital back once the fund is past its investment period and starts liquidating assets.

In addition to closed-end fund structures, GPs in general have been looking for ways to accumulate more AUM by accessing new pools of capital and generate product offerings with different duration profiles. Interval Funds, BDCs are all a product of this.

BDCs are just a subset of vehicles managed by Private Credit GPs.

BDCs are wrapper enabling a broader base of investors to participate in a given strategy. BDCs can be publicly traded (with liquidity available through the secondary market) or not (in which case there are typically redemption rights at NAV subject to % of NAV limitations). These vehicles make sense for GPs as they offer evergreen (semi-permanent) capital pools off which they earn a management fee in addition to accessing a more diverse investor base.

So is this systemic?

In the case of the GFC, bank balance sheets were significantly levered and customer deposits were at risk given the excessive push into subprime mortgage origination and trading. A 1% negative move could effectively wipe out the entire market cap of the bank.

A typical Private Credit fund is much more akin to Private Equity or VC in that the end-risk sits with LPs and while there may be some moderate use of leverage, we are talking maybe 30-40% on a Private Credit strategy where the underlying itself is typically <50% LTV, so call it <25% see-through LTV.

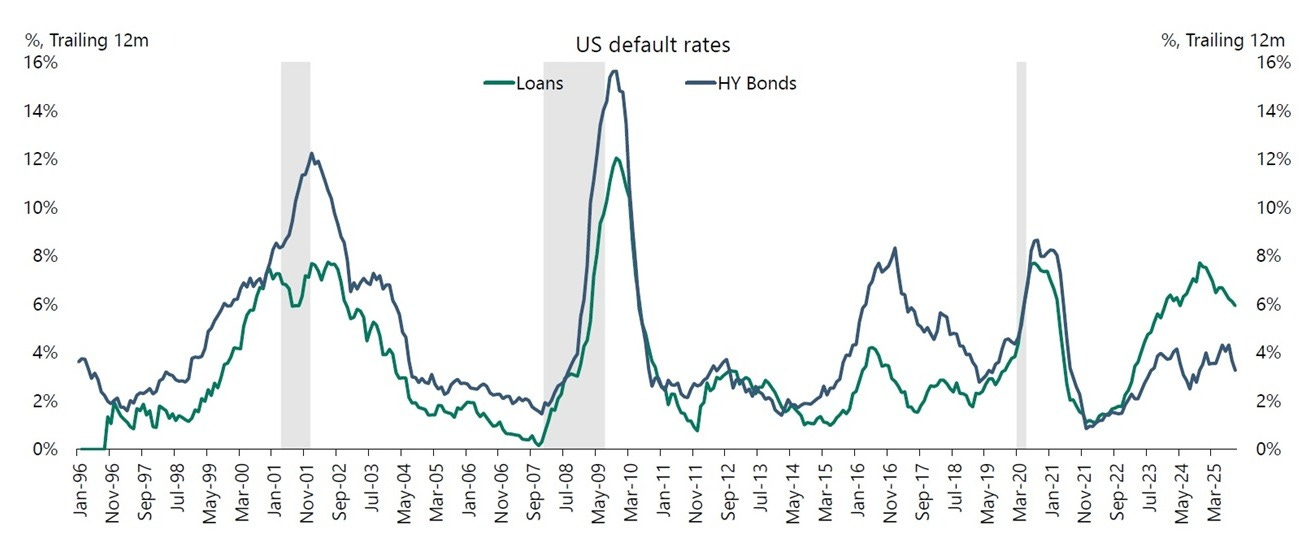

Fundamentally loan losses will tend to track the broader credit cycle:

Let’s say a Private Credit fund experiences defaults of 15% in its fund (which would match GFC levels), then you could still expect it to return ~1x to LPs on an unlevered basis (interest, par repayments, sub-par recoveries).

This is no different from any given investment strategy offering sub-par returns to investors. A 4% move in the S&P is $2.5T which is larger than all the credit-related AUM. If GIC, QIA, Norges suffered a 2% loss on their assets would that be systemic to the US economy?

The reason the topic blew up this week was to do with one of Blue Owl’s non-traded BDCs in the face of potentially accelerated redemptions. This is a typical duration mismatch issue and the reason why I tend to disagree with evergreen type vehicles for illiquid products. This does not mean that the underlying loans are all zeros (again, look at default rates through the credit cycle…).

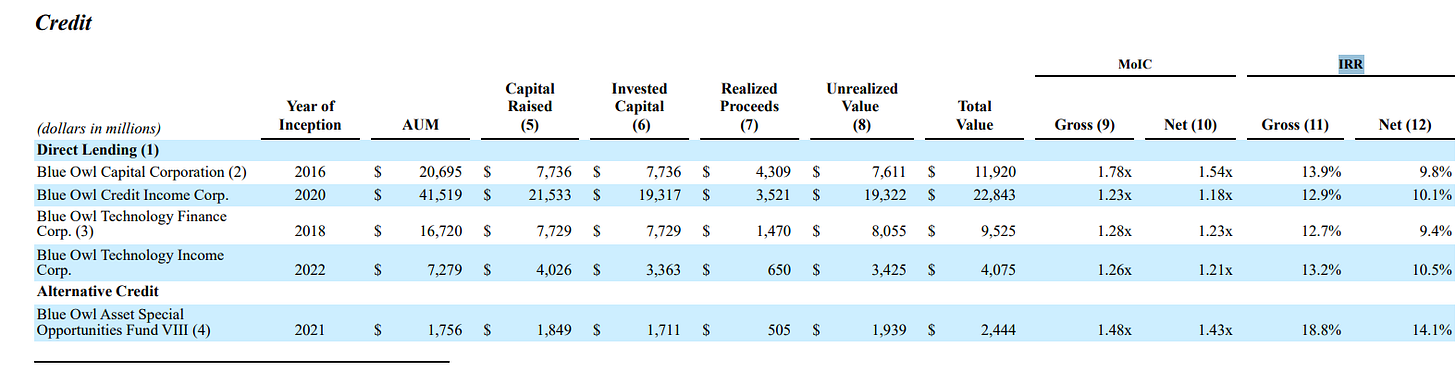

To put into perspective here are the performance metrics through 2025 in their credit segment:

What happened with OBDC II is quite similar to what happened with Blackstone on BREIT (I would argue that was worse).

When retail investors (even if HNW) are affected the topic always gets more political but is it fundamentally different folks losing millions on SPACs or Crypto? Is there a trigger for this to be too big to fail (large derivative exposure, housing crisis, customer deposits at risk)?

To me if there is a canary in the coal mine in the broader credit space it is potentially with life insurance where an excessive amount of product is being placed with sometimes creative ratings practices, but so far when I look at the metrics there is nothing that raises alarm bells to me.

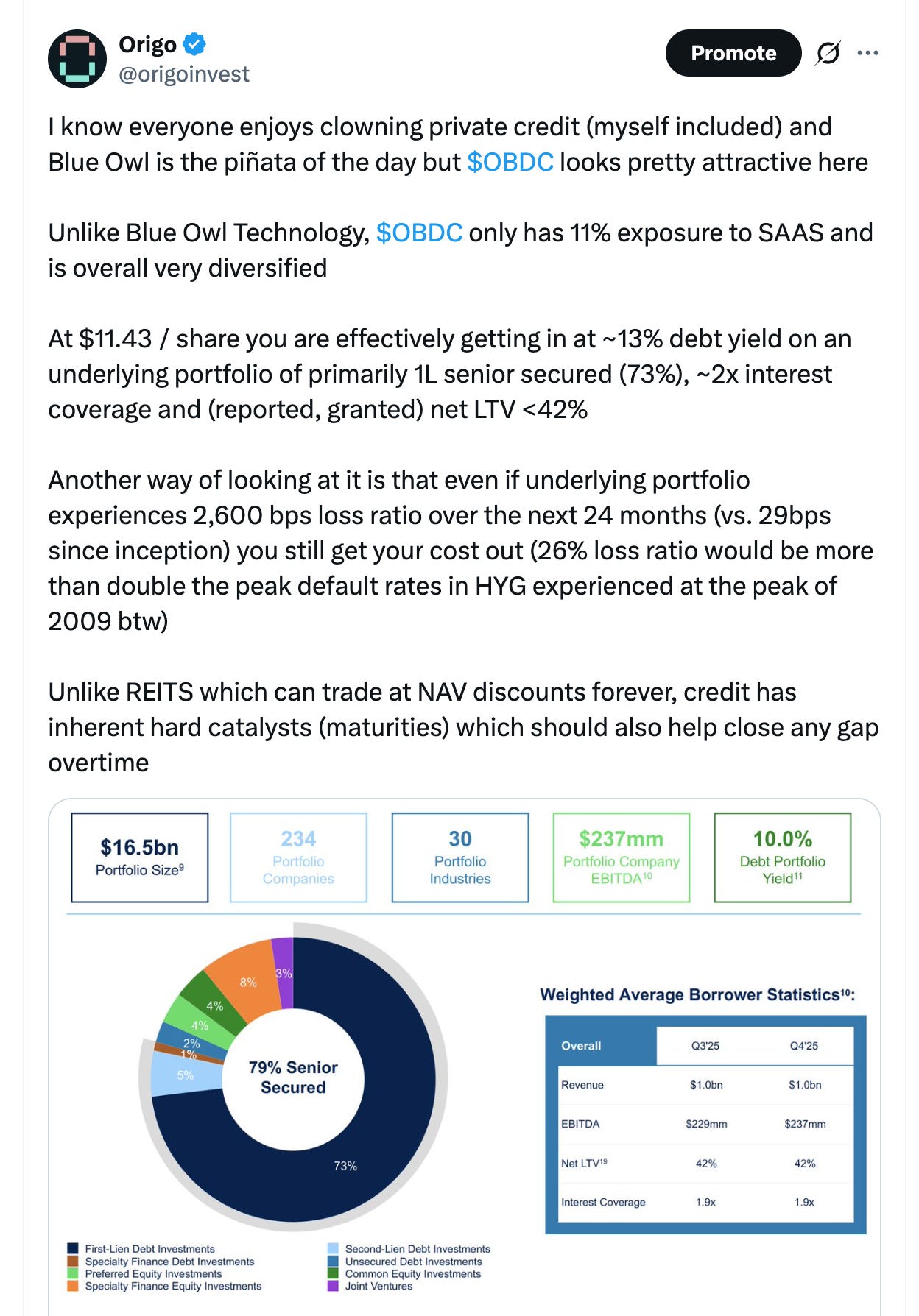

$OBDC, Blue Owl’s largest listed BDC

Take Blue Owl Capital Corp which is Blue Owl’s largest publicly traded BDC.

If you actually comb through the underlying metrics you will see that:

79% of its underlying assets are senior secured loans

It only has 11% exposure to SAAS

Interest coverage on its portfolio is 2x

Book is mostly cash pay, almost no PIK

Right now OBDC is trading at an implied 13% debt yield which is quite attractive. I am keeping tabs on this name as well as other BDCs. The key is to properly filter through the ones that have the higher quality loan books. The information is all readily available for those willing to do the work.

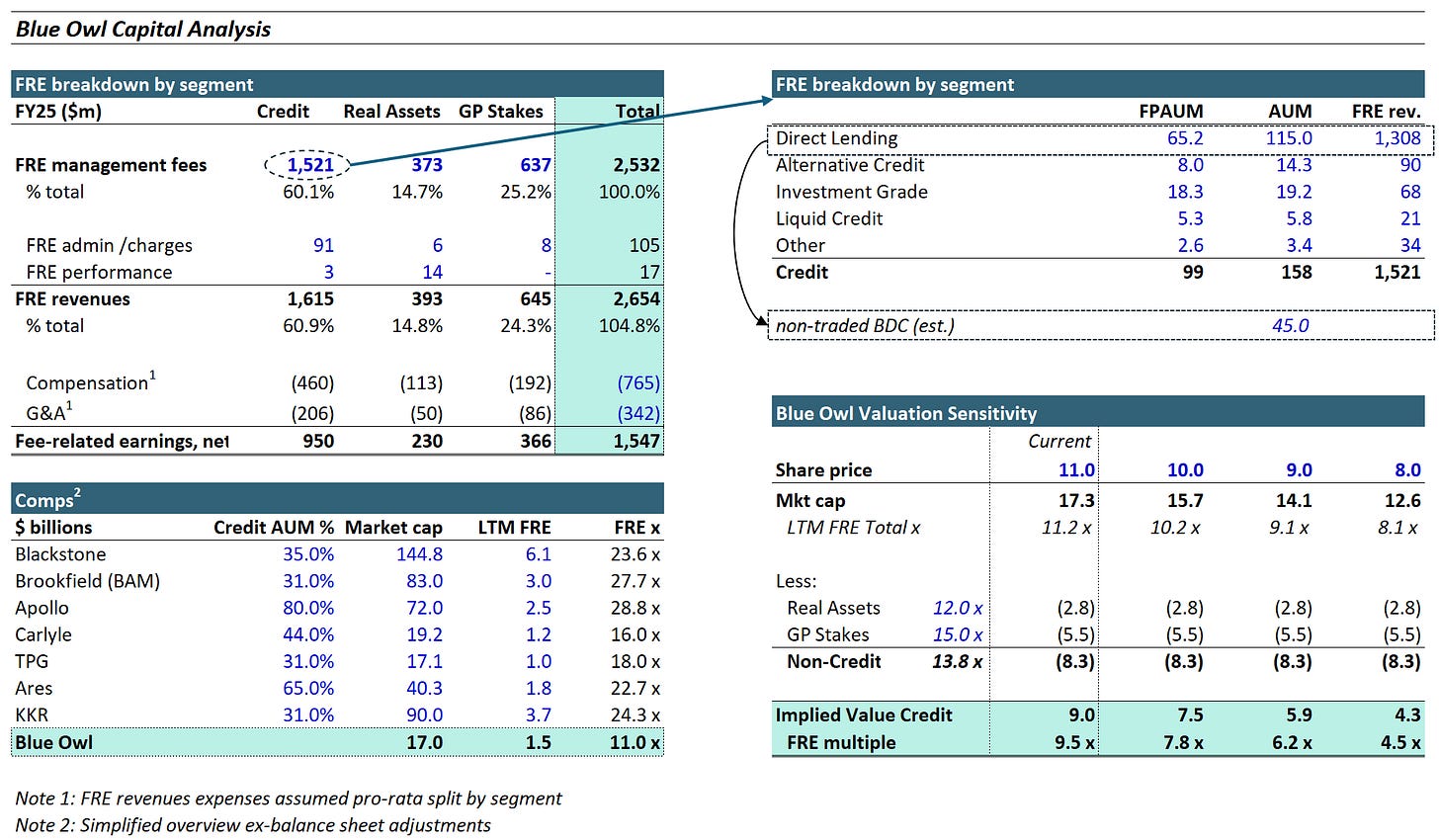

What about the asset managers and at what point is OWL a buy?

Big picture GPs have fantastic business models. They generate high margin, toll-like income on a very scalable business. Shares have gone up 3-5x over the past 5 years and so I believe a lot of the sell-off is related to multiple compression as expectations around AUM growth temper. Again, they do not experience P&L the way a bank does if their funds do poorly. The management fee is there no matter what. The main question is whether they can keep on raising funds and growing AUM. So far, the trend has been for large GPs to get larger as LPs have been concentrating their allocations. I expect this to continue to be the case.

Having said this, I don’t think they are particularly cheap despite the recent sell-off. Blue Owl on the other hand looks potentially very interesting particularly if it keeps selling off and gets to the $8-9/share range. Two points to note:

1) While 60% of its FRE is credit, it operates two other segments including a GP stakes business (formerly Dyal) which is a unique segment in a market where GPs have been actively consolidating north of >15x FRE

2) At 11x FRE $OWL is trading at a hefty discount to peers. I think there is a valid debate in terms of the multiple that you would ascribe on its direct-lending operations in a worst case scenario with accelerated redemption on its non-traded BDCs (which is a subset of a subset)

I think the non-credit business is worth at least $8B (15x GP stakes, 12x Real Assets) and there would be considerable appetite from the likes of $BAM $BN

You are then creating the residual credit business at 4.5-6.2x FRE which even in a run-off scenario is very attractive.