Hyperliquid HIP-3: Arbitrageur's Paradise (Part 1)

Farming carry trades on pre-IPO darlings: SpaceX, Anthropic and more

The interplay of scarcity, legacy and nascent markets offer ripe conditions for the discerning arbitrageur

What if you could long SpaceX at an implied $500B valuation and lock-in a valuation of $1.5T? Today we are going to look to at how to take advantage of the emergence of HIP-3 markets to construct trade set-ups with unique R/R profiles.

Hyperliquid and the growth of HIP-3 markets

For the purpose of this post I will assume that you are reasonably familiar with Hyperliquid and perpetual forwards. If you are coming from CT you can skip directly to Section 2. The brief summary is included below but for a more detailed overview you can refer to: https://hyperfoundation.org/

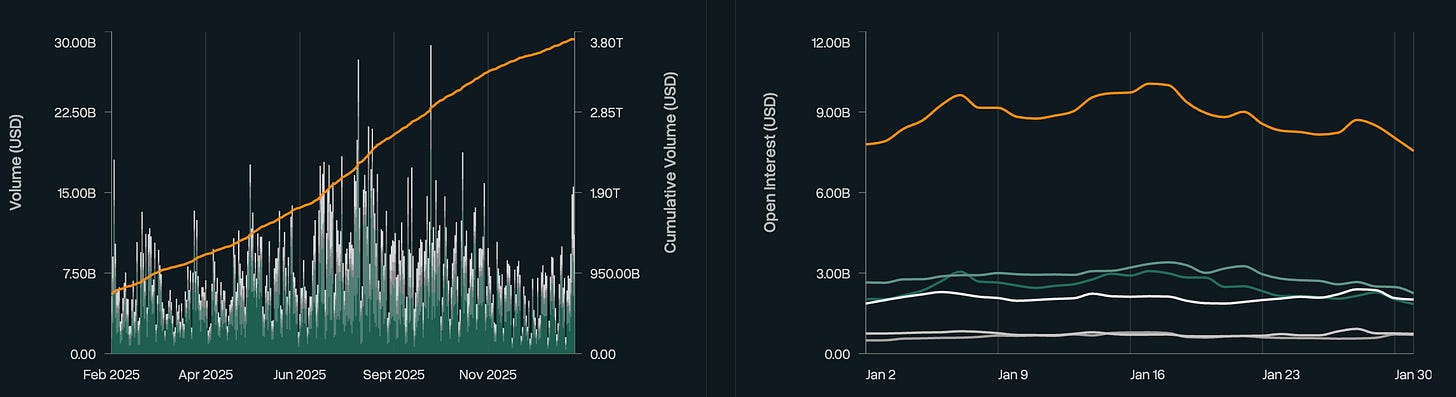

Hyperliquid is a decentralised exchange (DEX) which has now reached $3.8T in cumulative notional trading volume. What has underpinned its growth in market share is the team’s relentless focus on infrastructure and user experience which has now arguably surpassed that of traditional CEXs such as Binance or Bybit (all while being transparent and permissionless).

Hyperliquid has been a key innovator in the space and is at the forefront of becoming the “everything exchange”.

Here is a clip of Bob Diamond (former Barclays CEO) discussing Hyperliquid:

Perpetual forwards (along with stablecoins) have been one of crypto’s stickiest and notable inventions. At a basic level it allows parties to get notional exposure to an underlying asset (long or short) with no associated expiry. A funding rate mechanism is in place to ensure the trading price is closely linked to the underlying. When notional longs exceed shorts, the funding rate is positive and is paid to the shorts (and vice-versa).

Recently Hyperliquid introduced HIP-3, enabling new markets to be built on top of its platform. This includes equities, commodities and more relevant to our topic of the day: pre-IPO markets.

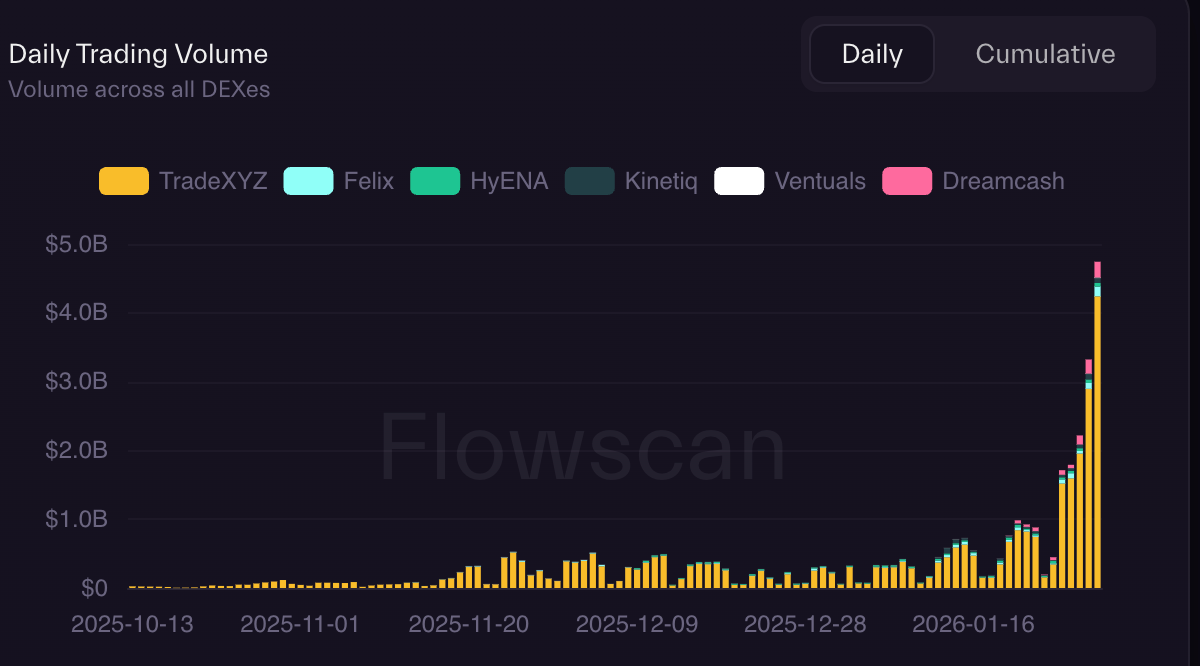

In a short amount of time HIP-3 markets have exploded in volume reaching over $4B in Daily Traded Volume this week. In other words these markets are getting increasingly liquid, while still being relatively nascent. Ripe for opportunity.

For a more mathematical overview of Perpetual Forwards and why we believe trading of equity perpetuals will soon crossover to TradFi and dominate existing derivative products, you can refer to the below article from Jez (@izebel_eth on X).

SpaceX on HIP-3

Lets take a look more specifically at the market for SpaceX.

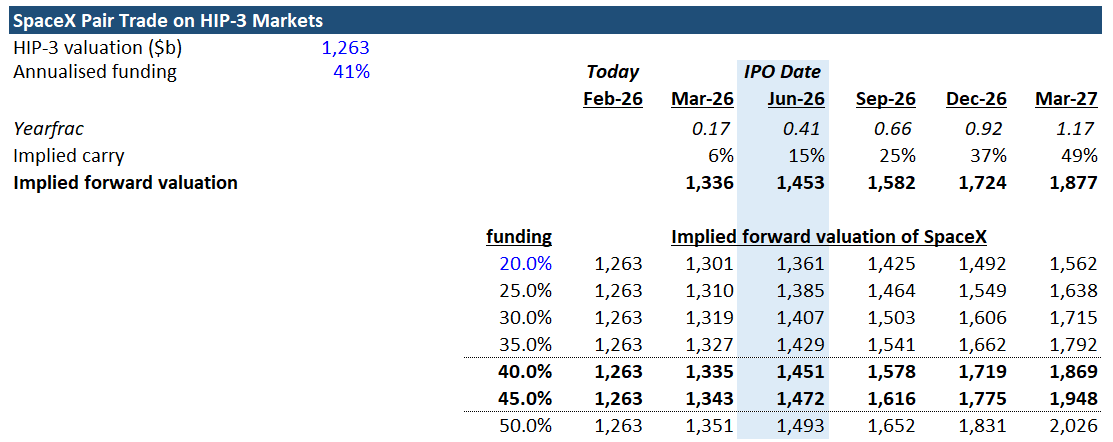

Currently one can buy SpaceX shares at a valuation of $1.26T.

Given the high demand to get long, the annualised borrow or funding rate is elevated at 40.5%. In other words, longs have to pay shorts 40.5% per annum on their notional exposure in order to remain long.

Given that pre-IPO markets are characterized by a clear “event”, the IPO, one way to think about this is the implied forward valuation of SpaceX shares which is a function of a) current valuation b) funding rate and c) expected IPO date. In other terms for longs to breakeven, given the carry costs, they would require SpaceX to IPO north of $1.45T by June (rumoured IPO date). If the IPO were to be delayed till Dec-26, this would rise to $1.85T.

Below is a range of implied forward valuations based on the current price, varying funding rates and IPO dates:

Looking at it from the short side, you are accruing positive carry and the further the IPO date gets pushed out the more “in the money” the position is.

This construct is very attractive and allows us to implicitly hedge any long exposure against both time decay and valuation.

As a side note, I prefer equity perps as the more nuanced and flexible tool as compared to prediction markets. An additional benefit of setting this trade up on Hyperliquid HIP-3 is the speculation that the next airdrop will skew rewards towards HIP-3 market participants. The first $HYPE airdrop was perhaps the most profitable of all time (and the overall prospects for $HYPE will be the topic of another post in the future).

Keep reading with a 7-day free trial

Subscribe to Origo Research to keep reading this post and get 7 days of free access to the full post archives.