Equity-like returns on an A- Rated Bond?

I discuss an alternative trade to a hotly debated stock

We’re so back

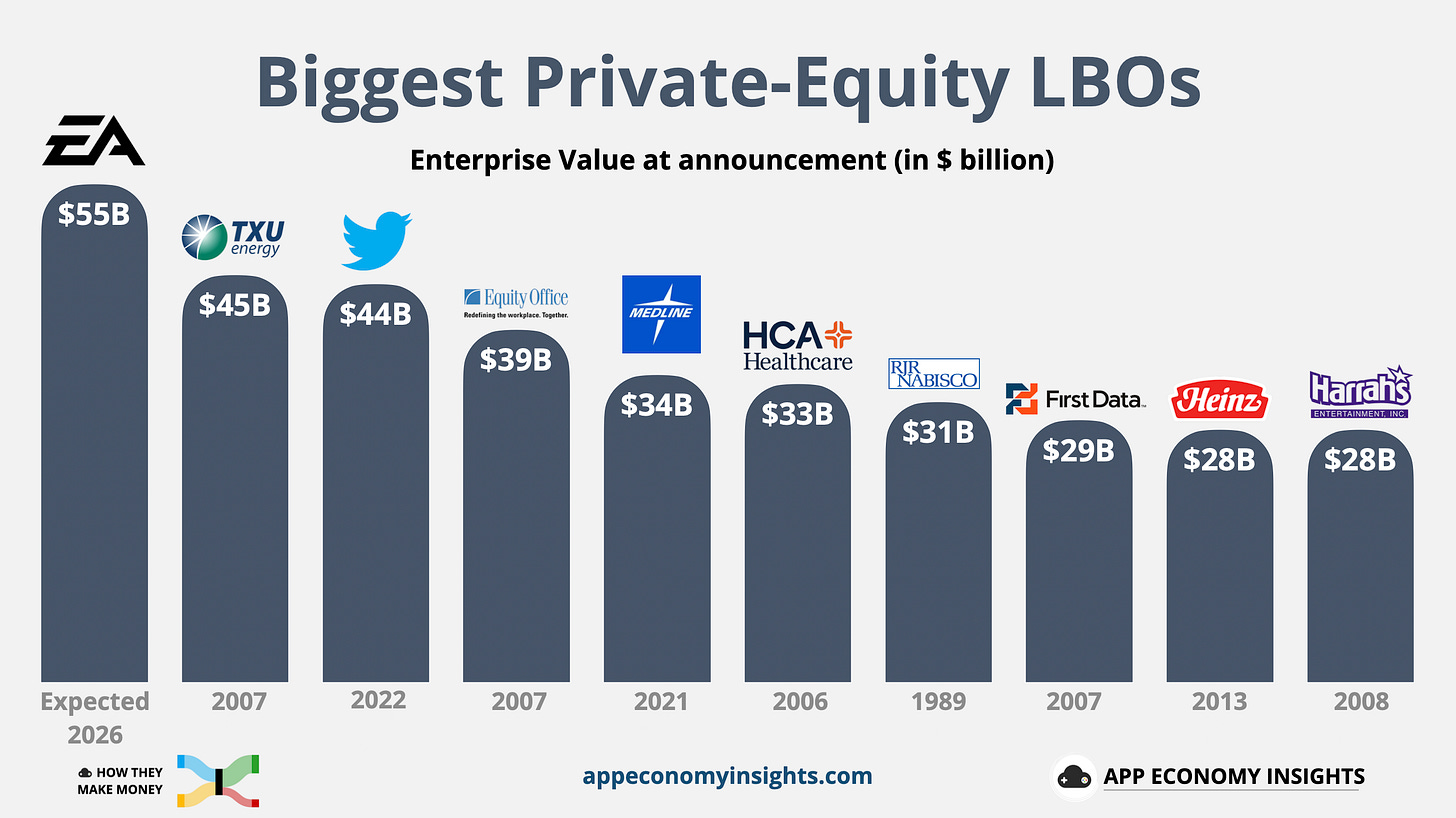

Around September last year we saw a take-private of Electronic Arts.

At first glance this transaction was most notable for its headline EV of $55B. A consortium of PIF, Silverlake and Affinity were able to cajole together an equity ticket of $36B to fund the largest LBO in history, topping the infamous KKR-TPG led takeover of TXU which marked the peak of the market pre-GFC.

Buyouts are back, baby!

Digging deeper

What subsequently piqued the interest of eagle-eyed observers was less obvious. One instrument within the EA capital structure, the 2051 bonds, had a CoC (change of control) put at par.

Clearly no one trading these bonds ever believed there was a remote chance in hell a Company of this size would ever get taken private. As such, they were trading on a YTM (yield-to-maturity) basis and given the long duration / low coupon combo in a higher rate environment this meant that the dollar price for the bonds was in the 60s.

The bonds subsequently gapped up 30 points on the day of the announcement. What a boon for all those real money bond holders who thought they were just clipping a coupon!

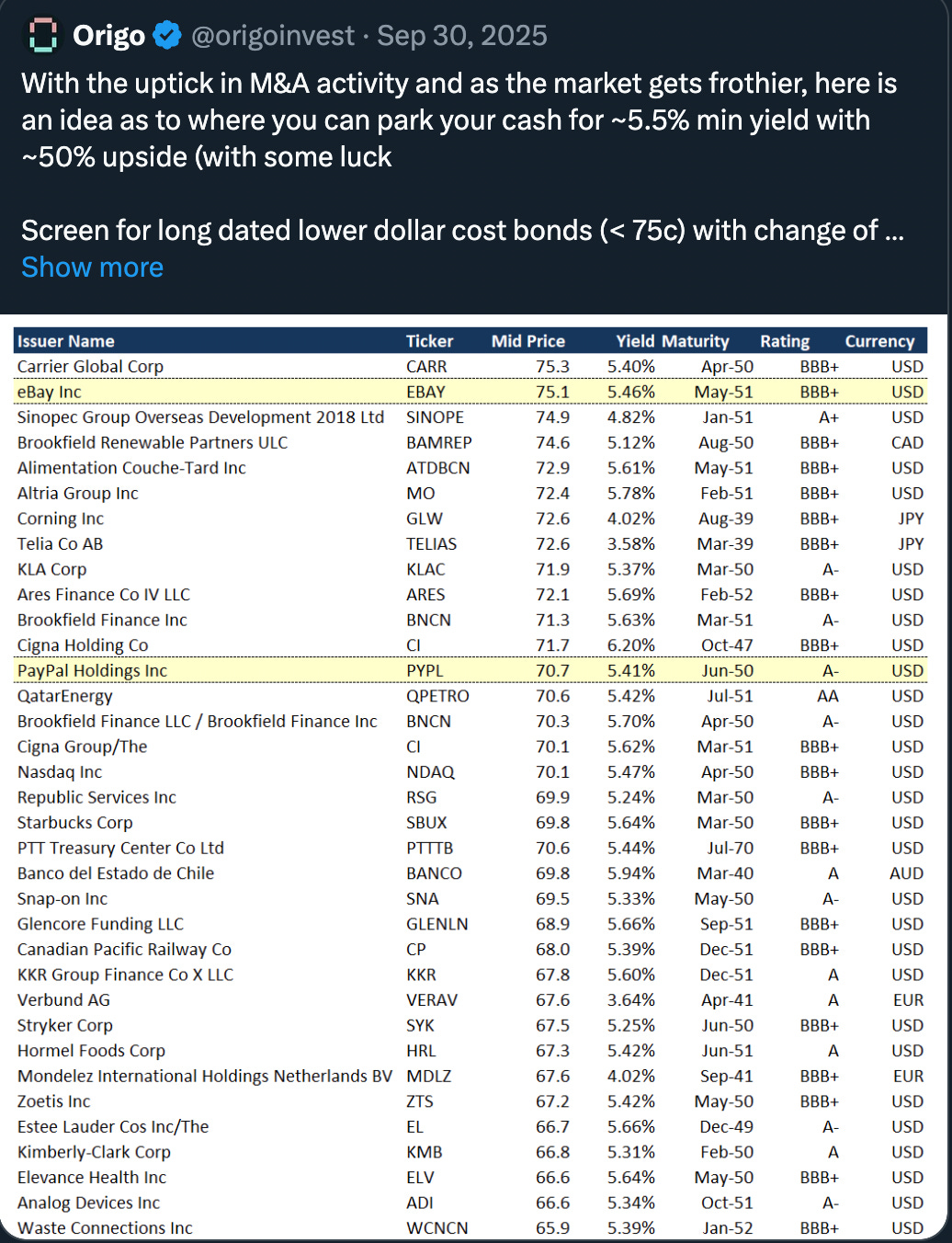

This led me to investigate further as to whether there were any other large cap issuers with similar duration bonds benefiting from CoC provisions.

My screen returned two names, namely eBay and, you’ve guessed it, PayPal.

An alternative trade on PayPal

Keep reading with a 7-day free trial

Subscribe to Origo Research to keep reading this post and get 7 days of free access to the full post archives.