EchoStar: SpaceX IPO, xAI merger and the path to $250 NAV / Share

Deep value meets hyper growth in this high conviction expected value play

So the stars are aligning and we finally have a timeline on a potential SpaceX IPO. Followers on X will know that we have been involved in EchoStar since the original spectrum sale to SpaceX was announced back in September and we cannot be more excited for what 2026 has in store for the name.

While the share price was languishing in the $70-80 zone, we were banging our fist on the table at the opportunity of investing in an “orphan” entity (having been a distressed capital structure for sometime) transitioning to the number one vehicle of choice for possibly the most anticipated IPO ever - a rare combination of deep value meets hyper growth and the definition of a true asymmetric set-up.

With some more clarity on timeline and valuation and with the recent pull-back to $113 / share, the R/R today looks arguably even better.

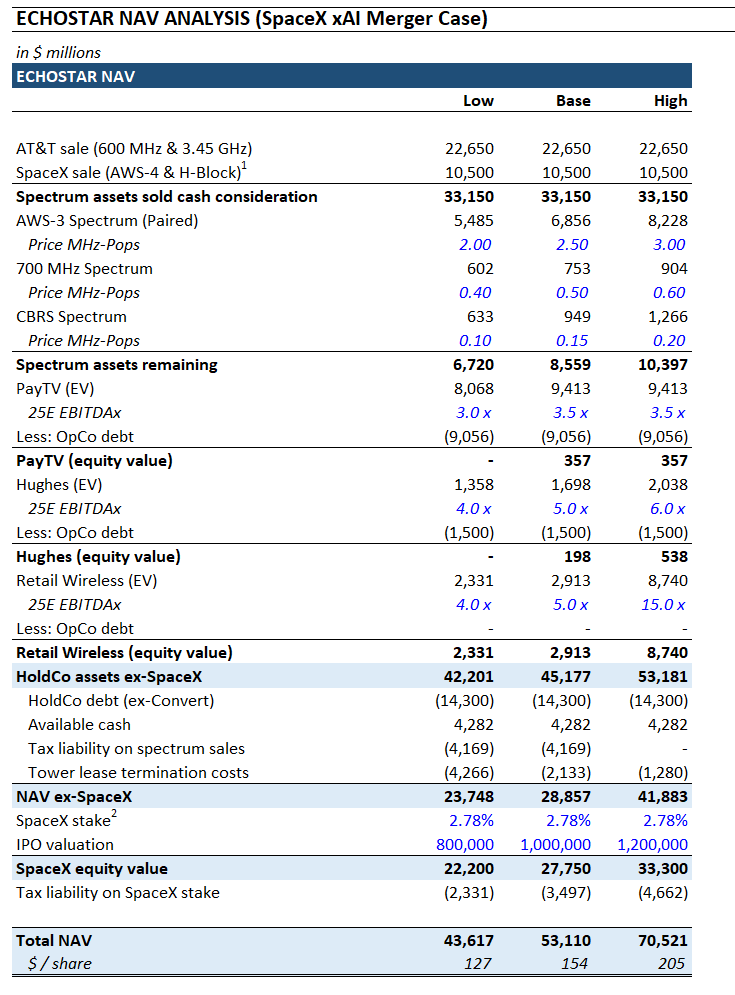

Firstly, let’s recap our NAV calculation for EchoStar and in particular the non-SpaceX component.

Updated NAV Analysis

Let's dive deeper into some of the swing factors at play:

1) Value ex-Space X:

Keep reading with a 7-day free trial

Subscribe to Origo Research to keep reading this post and get 7 days of free access to the full post archives.