CVC and Ares Caught Offside (Part 1)

Sports Investing: Misadventures in French Football

“What the wise man does in the beginning, the fool does in the end.”

Stay in the investing world long enough and you will develop a fierce ability for pattern recognition. New narratives, same capital cycles and investor behaviour.

CVC is staring at a massive write-down on its €1.5B investment in the French Football Ligue’s commercial rights after less than 3 years.

Ares has marked its residual loan in Eagle Holdings, owner of French club Olympique Lyonnais, down to 32c.

In each instance both firms were latching on to a headline thematic while wearing blinders to its evolving nuances.

This is what happens when an asset class gains in popularity, invites excess capital and spawns an ecosystem incentivised to do deals.

In Part 1, I leverage French public disclosures to re-underwrite the CVC deal.

This short exposé is also intended to illustrate 3 investing takeaways:

Thematic exposure to an upcycle is only half the battle

Deep in a trend, nuance matters

Value (almost) always accrues to the top

The Golden Era of Media Sports Rights

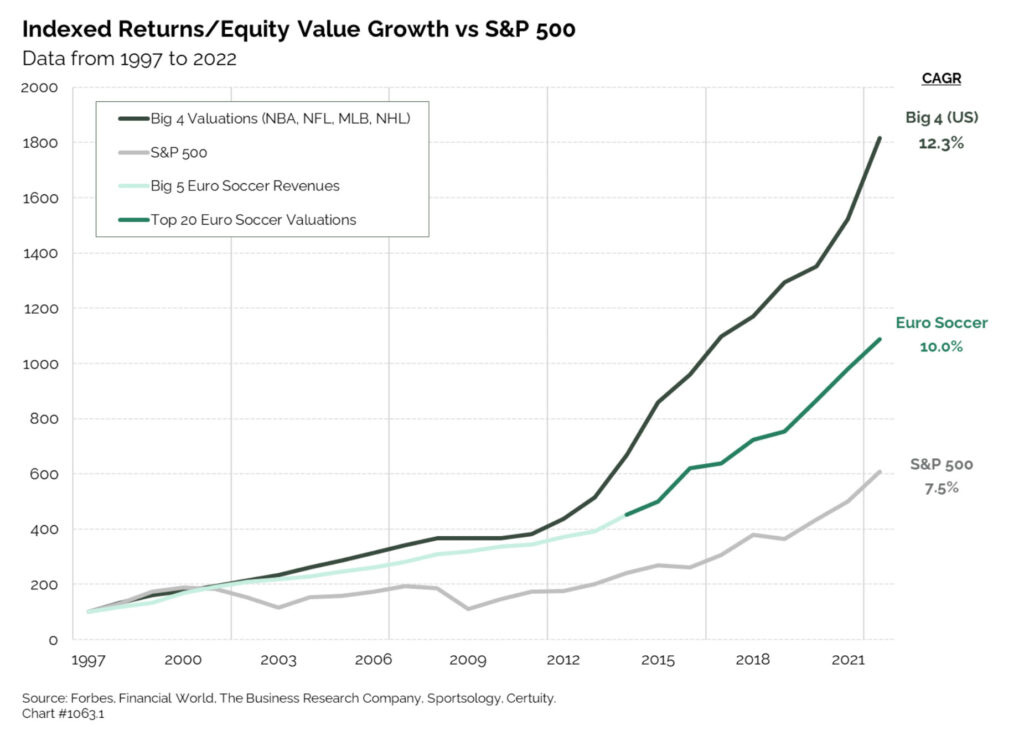

For the past few decades major sports assets significantly outperformed the S&P. This phenomenon accelerated in 2012 as live sports became a core differentiator for cable networks battling content unbundling through the emergence of OTT services.

NBA and NFL franchises experienced a meteoric rise with valuations returning 6-8x on the back of blockbuster broadcasting deals.

Keep reading with a 7-day free trial

Subscribe to Origo Research to keep reading this post and get 7 days of free access to the full post archives.